Cyber Liability Insurance

from Bill White Insurance Agency

Cyber Liability Insurance

The risk to your business from cyber intrusion is real. Make sure your business in Springfield, Ozark, Nixa Missouri, is protected with Cyber Insurance coverage options from Bill White Insurance.

Cyber-attacks are growing more and more common, and no business of any size is immune. Your business’s ability to survive an attack depends on your ability to prevent incidents and return to normal operations quickly. Your business needs Cyber Liability Insurance for certain, but you’ll need more. Make no mistake, get coverage in place first – That’s priority one! You can become a cybersecurity expert later, but you need an integrated cyber policy that includes cybersecurity education services to help prevent a cyber incident from happening in the first place.

Understanding Cyber Coverages and Exposures

You may be asking yourself “What is cyber insurance and why do you need it?” or “What does cyber insurance cost?”. You’re not alone, according to a 2019 Cyber Insurance survey, "not understanding exposures" (73%), "not understanding coverage" (63%), and "cost" (46%) remain the top three identified obstacles to the purchase of cyber insurance. It’s no surprise that cost is an obstacle if a business doesn’t understand cyber exposures or how insurance coverage will react.

The same report cited common myths held by some in business. The idea of using the services of an outside IT company with their own cyber coverage being sufficient, or just the organization’s pride in their own good system or IT person being enough to prevent a hack.

As of 2020, the percentage of small and medium-sized businesses (SMBs) who reported having no cyber insurance coverage was 64%. The percentage of SMB’s who reported having already fallen victim to a ransomware attack was 16%.

A quick look at what Cyber Insurance Covers

The most basic of Cyber Insurance policies should provide coverage for these two main exposures.

First-Party Security Breach Expense – Typically includes coverage for these expenses:

- Legal and forensic services for investigating whether a breach occurred

- Notification to impacted parties

- Post-event credit monitoring for impacted parties

- Public relations expenses to help protect and/or restore a business’s reputation

Third-Party Defense and Liability Coverage

- Provides coverage for civil awards, judgments, or settlements a business must pay as damages to a third-party as a result of a security breach claim. Other regulatory costs may be included as well.

In addition to the two main exposures described above, other coverage may be included or offered as optional for additional premium including:

- Cyber Crime – like Social Engineering and Fraudulent Funds Transfer

- Extortion Threats – including negotiation and ransom payments

- Hardware Replacement Costs – for hardware rendered useless after a breach.

- Business Interruption – For lost or reduced revenue after the breach

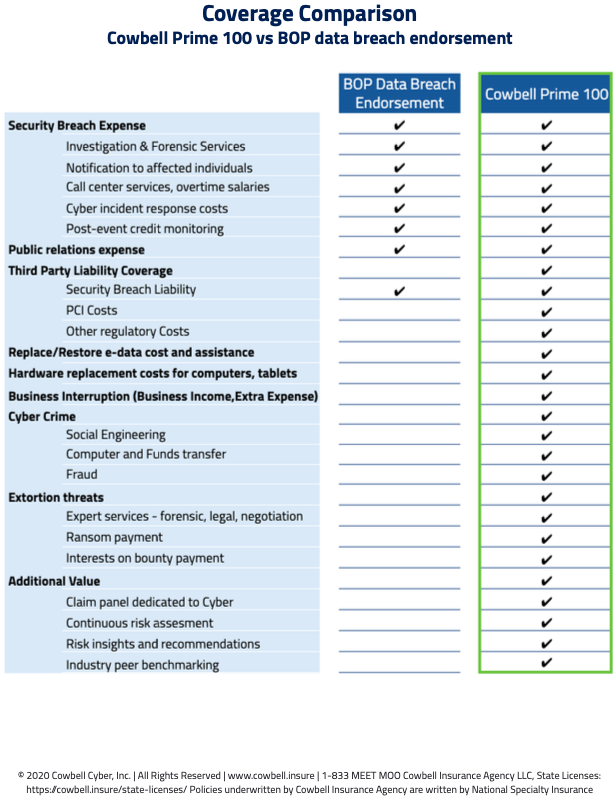

Currently, at least 192 US insurers offer some form of cyber liability coverage as either a standalone policy or as an endorsement adding cyber coverage to an existing business owner (BOP) policy. We believe a standalone policy that clearly identifies coverage and limits is the best approach. The graphic below shows the coverage difference between a standalone policy from Cowbell Cyber compared to the endorsement you might find on a typical BOP. Of course, something is always better than nothing when your business is the victim of cyber-crime, and most SMB leaders now realize a system breach is a question of “When” and not “If”.

The Traditional Approach to Cyber Liability

Insurance underwriting for Cyber Liability has traditionally worked like most other specialty lines of insurance. Meaning, the agent asks the business to complete a lengthy application, filled with technology jargon, to help a human underwriter determine if the proper safeguards are in place to protect the organization’s network from sophisticated, professional hackers. The underwriter is making an acceptability and pricing decision based on the organization’s expertise in cybersecurity. This approach assumes the business seeking coverage probably has an IT professional on staff or at least has access to one. For many SMB’s that’s not the case, and the business owner is also managing the network.

The Next Generation Approach to Cyber Liability

Our current landscape of rapidly changing cyber threat exposures has prompted some insurance carriers to take a next-generation approach to underwriting. The difference from the traditional approach to this new, let’s call it 2.0 approach, is to replace the human underwriter in favor of a continuous automated underwriting platform. There is no way for a business to know every vulnerability that may be actively lurking on their network. So, the new underwriting model uses artificial intelligence to map insurable threats and risk exposures, to determine the probability of threats, and their impact on coverage types. This unique AI approach to risk selection underwriting and pricing compresses the entire insurance process, from quote to application to issuing a policy in about 5 minutes.

That is worth repeating, and here is the value proposition again. Bill White Insurance, along with our partner Cowbell Cyber, can quote and issue Cyber Liability coverage for most businesses in about 5 minutes! Getting a Cyber Insurance quote and a policy issued has never been easier, so schedule a few minutes for a quote today!

Get a

Get a